Weathering the Storm

Uncertainty creates fear. And right now, there is lots of uncertainty in the world. How can we navigate through that?

A Charlottesville Follow-Up to our Long-Term Care Conversation

You may have caught my segment on Today y Mañana, a local Charlottesville podcast we are hosting through the iLoveCville network every Thursday at 10:15 am (You can check it out here). If you did not manage to tune in (you should!), our topic of discussion was Long-Term Care Insurance in our domestic market of Charlottesville, Virginia from a financial planning standpoint.

You Can’t Retire If You Haven’t Saved

Spending is fun. The same can’t be said for saving. As fun as spending may be, saving money has far greater benefits for us as we near retirement. Waiting for the last minute to save will not yield the same results as saving early in your life will. Just a little saving early on can go a long way to a more fruitful and happy retirement….

Long Term Care Insurance: the big “What If?”

The future can be daunting to dwell on. Wondering where you might be 1, 2, 5 years from now can be both frightening and exciting. What about thinking 30, 40, or even 50 years into the future? Well, that’s even more terrifying, but in some cases, can also be necessary. It is never too early to start thinking about your retirement, and it is never too early to start thinking about long-term care.

Letting Your Money Work For You

Whether you avidly follow the stock market or simply tend to glance weekly at its rise or fall, everyone at this point knows that the market has gone up quite considerably in 2021. In fact, it has gone up so much this year that it has some people spooked. How could the market be rising month after month and yet have people being scared to enter?

Thinking Long-Term

It can often be enticing to set out into the investing world with your financial advisor, but it always helps to make sure you have a destination before you begin. Investing isn’t a sprint—it’s a marathon. Thinking long-term about your finances and your goals can help set you on the right path to achieving those set goals, ultimately resulting in a happy, healthy, and secure retirement. Here are 3 long-term questions you should be contemplating right now…

Power and Influence

I usually make it a habit to avoid taking surveys. I recently made an exception, however, for a survey from Investing.com when I saw it was on the subject of Elon Musk. Elon Musk, the famous entrepreneur, investor, and personality, has recently come under fire for his mixed signals on the value of cryptocurrency. The main question of the survey was “Does Elon Musk have too much power?”

Risotto Investing

I decided to commit to the title of this blog, despite that it may or may not imply that I’m recommending putting money into rice. With inflation concerns entering the public and private consciousness as well as affecting other commodity areas such as lumber, it may not seem totally unlikely that someone would recommend a commodity as an investment.

Zen Investing

I discovered Zen Buddhist Koans while I was studying the spread of Buddhism in college, and since then, have had a particular fascination with them. An extremely brief Kafkaesque story with depth and symbolic meaning that can be confusing, humorous, tragic, entertaining, and enlightening? Sign me up!

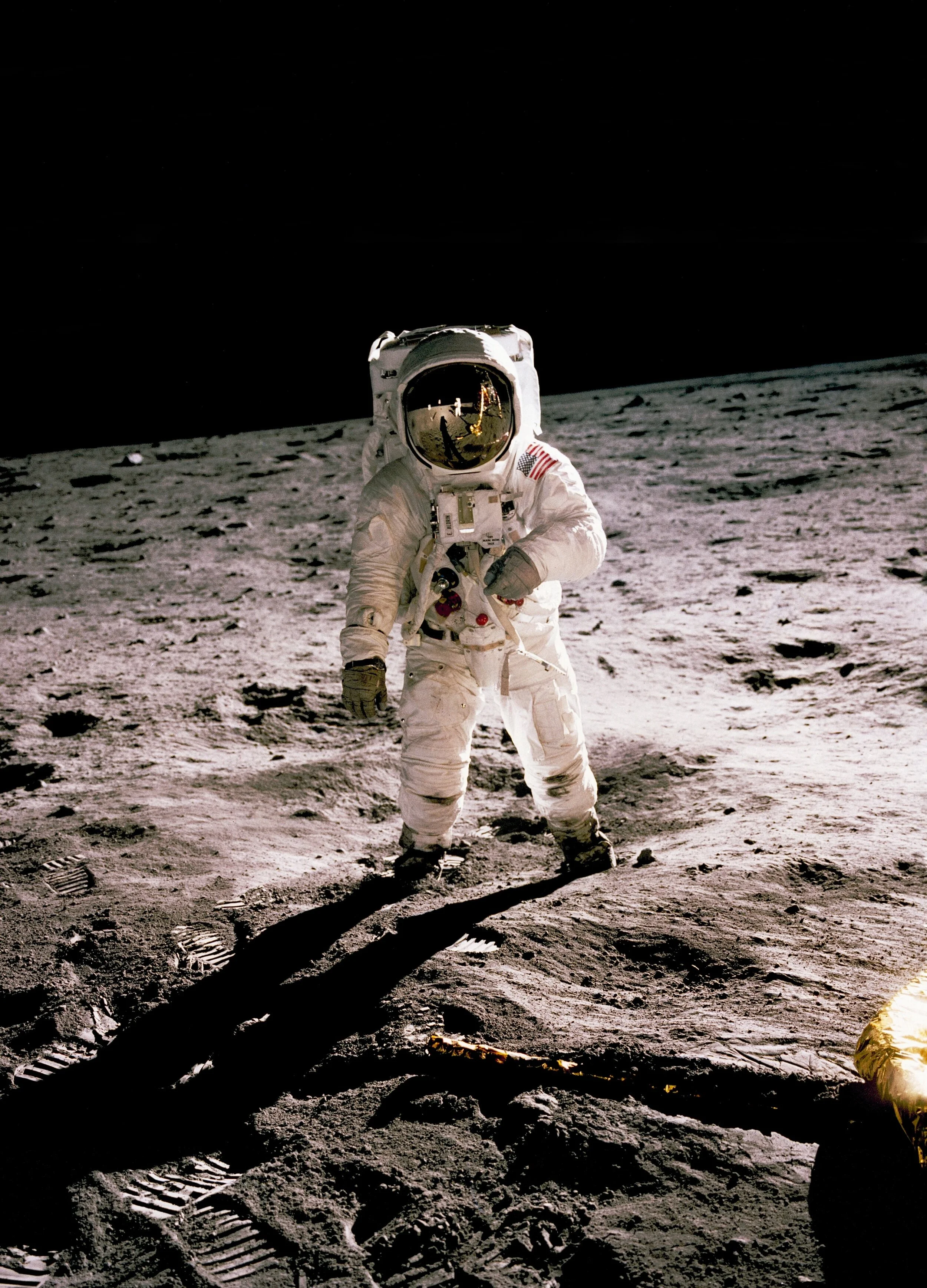

The Man on the Moon: Mining

Who owns space? Who owns the moon? Or do we refer to space as the final frontier for pioneers of human experience to be able to realize their dreams of economizing resources and providing for earth’s inhabitants?

Robinhood: The Free Lunch That Isn’t

What do unicorns and free lunches have in common? That’s right, neither of them exist, (though if I could choose one or the other, I would take a free lunch in a heartbeat). While the phrase, “there’s no such thing as a free lunch” is well-enough known, it’s also one of the most easily forgotten wisdoms in today’s America. We are all so willing to believe that free is good, we scarcely stop to question the price of that free stuff.